Mysterious $36.29 e-Transfer from MNP? Why Facebook Sent You: Ever received a seemingly random e-transfer from an unknown sender? This article dives into a puzzling case involving a $36.29 e-transfer seemingly linked to Facebook, exploring potential scams, security breaches, and how to protect yourself. We’ll unpack the mystery behind the sender “MNP,” the oddly specific amount, and what you should do if you encounter a similar situation.

We’ll examine the characteristics of legitimate e-transfers and contrast them with the red flags of fraudulent transactions. We’ll explore the possible connections between Facebook and this suspicious activity, including phishing scams and compromised accounts. Finally, we’ll provide practical steps to safeguard your financial information and what actions to take if you believe you’ve been targeted.

Understanding Mysterious E-Transfers: Mysterious .29 E-Transfer From MNP? Why Facebook Sent You

Receiving an unexpected e-transfer, especially a small amount like $36.29 from an unknown sender like “MNP,” raises immediate concerns about potential fraud. This article will dissect the characteristics of legitimate and fraudulent e-transfers, explore the possible connection to Facebook, investigate the sender’s identity, and analyze the unusual transaction amount to help you understand and protect yourself from similar scams.

Legitimate E-Transfer Characteristics and Red Flags

Legitimate e-transfers typically originate from known senders, have a clear purpose stated in the transfer details (e.g., “Payment for goods,” “Loan repayment”), and the amount aligns with expected transactions. Red flags include unexpected transfers from unknown senders, vague or missing transfer descriptions, and unusually small or large amounts. The $36.29 amount is atypical for large fraudulent transactions, which often involve significantly higher sums, suggesting a different approach to the scam.

That weird $36.29 e-transfer from MNP? It’s probably related to a Facebook ad or something similar. Think about it – tracking online payments is tricky, especially with international transactions, which is why better tracking of foreign student activity, as highlighted in this article Canada should better track foreign student departures: criminologist , is so important. If you can’t figure out the $36.29, contact Facebook directly; they might have more info on the source of the payment.

Facebook’s Potential Involvement

The association of Facebook with this e-transfer might be due to several reasons. Phishing scams often use social media platforms to gain user trust, potentially using compromised accounts or exploiting vulnerabilities in Facebook’s systems to send fraudulent e-transfers. Data breaches or compromised accounts could lead to scammers accessing user information and initiating transactions.

So you got a weird $36.29 e-transfer from MNP? Think it’s Facebook related? Maybe it’s a sign you should buy a lottery ticket! I mean, someone just won a massive $1.22 billion in the Mega Millions, check it out: Winning ticket for $1.22 billion Mega Millions jackpot sold in California. Anyway, back to that mystery money – best to be cautious and investigate that MNP transfer before celebrating any early wins!

Investigating the Sender “MNP”, Mysterious .29 e-Transfer from MNP? Why Facebook Sent You

The sender identifier “MNP” requires further investigation. Its meaning could range from an abbreviation used in a specific context to a deliberately obfuscated identifier. Further research is needed to determine its origin and potential connection to fraudulent activities.

| Possible Meaning | Likelihood | Explanation | Supporting Evidence |

|---|---|---|---|

| Mobile Network Provider (initials) | Medium | Could be a misdirection tactic using seemingly innocuous initials. | Many businesses use initials in their names. |

| Randomly generated code | High | Scammers often use random or nonsensical identifiers to avoid traceability. | Common practice in phishing and other online scams. |

| Acronym for a specific organization (unidentified) | Low | Requires extensive research to determine if “MNP” is associated with any known entities. | Needs further investigation. |

| Part of a larger code or identifier | Medium | Could be a segment of a more complex identifier used to track transactions. | Common in sophisticated fraud schemes. |

A hypothetical scenario involves a scammer using “MNP” as a seemingly harmless identifier in a phishing email or text message, directing the recipient to a fraudulent website to enter their banking details.

Steps to investigate “MNP” include using online search engines to find associated entities, checking social media for mentions, and attempting to trace the e-transfer’s origin through the financial institution.

So, you got a mysterious $36.29 e-transfer from MNP? Think it’s Facebook? Before you panic, consider this: sometimes seemingly random payments are related to online activities. For example, you might check out ALW In Focus: Tijan McKenna to see if it relates to any online purchases or subscriptions you’ve made. Then, if you’re still stumped about that $36.29, double-check your recent online transactions for any small charges you might have forgotten.

Analyzing the Transaction Amount ($36.29)

The seemingly arbitrary amount of $36.29 is psychologically significant. It’s small enough to seem insignificant, making victims less likely to investigate immediately. Scammers may choose this amount to test the waters, seeing if the recipient notices the transfer. It avoids triggering fraud alerts associated with larger sums. The amount is unusual compared to common online transactions, which are typically rounded numbers or relate to specific goods/services.

This could be a small part of a larger scheme, a test transaction before attempting a larger fraudulent transfer.

Safety Precautions and Prevention

Protecting yourself from similar scams involves several crucial steps. Always verify the sender’s identity before accepting e-transfers. Be wary of unexpected transactions and those with vague descriptions. Regularly review your bank statements for any unauthorized activity.

- Never click on links or open attachments from unknown senders.

- Use strong and unique passwords for all online accounts.

- Enable two-factor authentication wherever possible.

- Regularly update your software and security applications.

- Be cautious about sharing personal information online.

- Report suspicious activity to your bank and relevant authorities.

Robust management of personal information on social media is vital. Avoid sharing sensitive details, such as financial information or login credentials. If you suspect fraudulent activity, immediately contact your bank and report the incident to the appropriate authorities.

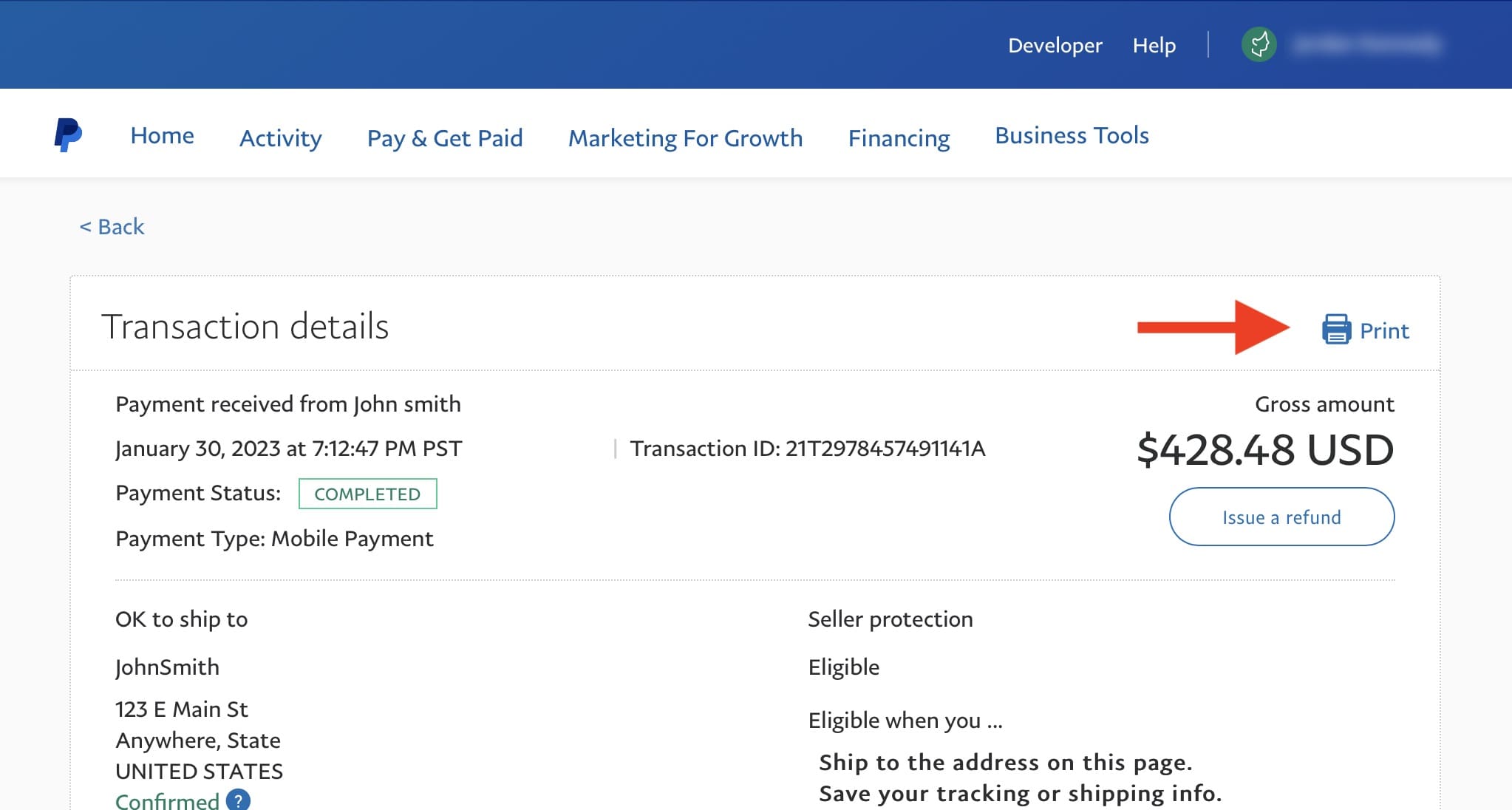

Visual Representation of the Scam

A phishing email might use a Facebook logo, a seemingly legitimate sender address (potentially masking the real “MNP” sender), and a subject line like “Facebook Payment Notification” or “Security Alert.” The email body might contain a link to a fake Facebook login page, urging the recipient to verify their account or update their payment information. Visual cues indicating fraud include poor grammar, misspellings, inconsistencies in branding, and the use of generic greetings instead of personalized ones.

The deceptive website would mimic Facebook’s design but contain subtle differences (e.g., slightly altered URLs, incorrect font styles, different logo placements).

Last Recap

So, that mysterious $36.29 e-transfer from “MNP” potentially linked to Facebook? It highlights the ever-evolving landscape of online scams. Understanding the red flags, investigating suspicious senders, and prioritizing online security are crucial for protecting yourself. Remember, if something feels off, it probably is. Take the necessary steps to verify the sender and report any suspicious activity immediately.

Staying vigilant is your best defense against these types of scams.

Expert Answers

What does “MNP” likely stand for?

It’s impossible to say for certain without more information. It could be an abbreviation, a random string of characters, or even a deliberately obfuscated identifier used by scammers.

Is $36.29 a common amount for scams?

Not particularly. Scammers often choose small amounts to test if the transfer goes through unnoticed, before escalating to larger sums.

What if I already accepted the e-transfer?

Contact your bank immediately. They can help you understand the transaction and potentially reverse it. Report the incident to the appropriate authorities.

How can I prevent this from happening again?

Be wary of unsolicited e-transfers. Verify the sender’s identity before accepting any funds. Keep your social media accounts secure with strong passwords and two-factor authentication.